|

الملاحظات

|

|

خيارات الموضوع | ابحث بهذا الموضوع |

|

Auto Trading Made Easy New sources of trade we have only Characterized by fast All countries in the world rules have been met, traders will not be able to hesitate or question the trade. In addition to helping traders who are afraid to "pull the trigger", automated trading can curb those who are apt to overtrade – buying and selling at every perceived opportunity.

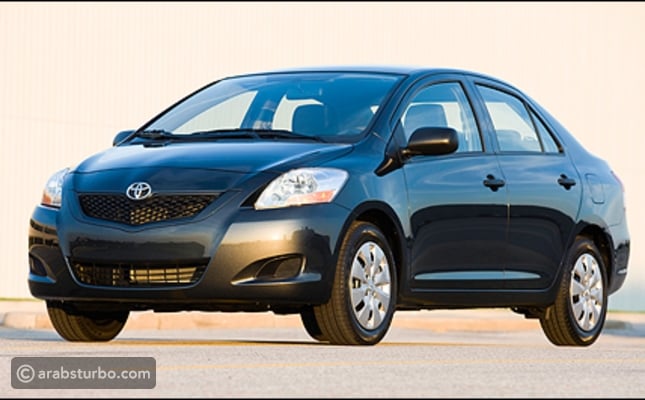

صور السيارات التجارية  Ability to Backtest. Backtesting applies trading rules to historical market data to determine the viability of the idea. When designing a system for automated trading, all rules need to be absolute, with no room for interpretation (the computer cannot make guesses – it has to be told exactly what to do). Traders can take these precise sets of rules and test them on historical data before risking money in live trading. Careful backtesting allows traders to evaluate and fine-tune a trading idea, and to determine the system's expectancy – the average amount that a trader can expect to win (or lose) per unit of risk. (We offer some tips on this process that can help refind your current trading strategies. For more, see Backtesting: Interpreting the Past.) Preserve Discipline. Because the trade rules are established and trade execution is performed automatically, discipline is preserved even in volatile markets. Discipline is often lost due to emotional factors such as fear of taking a loss, or the desire to eke out a little more profit from a trade. Automated trading helps ensure that discipline is maintained because the trading plan will be followed exactly. In addition, pilot-error is minimized, and an order to buy 100 shares will not be incorrectly entered as an order to sell 1,000 shares. صور السيارات التجارية   > >    Achieve Consistency. One of the biggest challenges in trading is to plan the trade and trade the plan. Even if a trading plan has the potential to be profitable, traders who ignore the rules are altering any expectancy the system would have had. There is no such thing as a trading plan that wins 100% of the time – losses are a part of the game. But losses can be psychologically traumatizing, so a trader who has two or three losing trades in a row might decide to skip the next trade. If this next trade would have been a winner, the trader has already destroyed any expectancy the system had. Automated trading systems allow traders to achieve consistency by trading the plan. (It's impossible to avoid disaster without trading rules. For more, see 10 Steps to Building a Winning Trading Plan.) Improved Order Entry Speed. Since computers respond immediately to changing market conditions, automated systems are able to generate orders as soon as trade criteria are met. Getting in or out of a trade a few seconds earlier can make a big difference in the trade's outcome. As soon as a position is entered, all other orders are automatically generated, including protective stop losses and profit targets. Markets can move quickly, and it is demoralizing to have a trade reach the profit target or blow past a stop loss level – before the orders can even be entered. An automated trading system prevents this from happening. Diversify Trading. Automated trading systems permit the user to trade multiple accounts or various strategies at one time. This has the potential to spread risk over various instruments while creating a hedge against losing positions. What would be incredibly challenging for a human to accomplish is efficiently executed by a computer in a matter of milliseconds. The computer is able to scan for trading opportunities across a range of markets, generate orders and monitor trades. Disadvantages and Realities of Automated Trading Systems Automated trading systems boast many advantages, but there are some downfalls of and realties to which traders should be aware. Mechanical failures. The theory behind automated trading makes it seem simple: set up the software, program the rules and watch it trade. In reality, however, automated trading is a sophisticated method of trading, yet not infallible. Depending on the trading platform, a trade order could reside on a computer – and not a server. What that means is that if an Internet connection is lost, an order might not be sent to the market. There could also be a discrepancy between the "theoretical trades" generated by the strategy and the order entry platform component that turns them into real trades. Most traders should expect a learning curve when using automated trading systems, and it is generally a good idea to start with small trade sizes while the process is refined. Monitoring. Although it would be great to turn on the computer and leave for the day, automated trading systems do require monitoring. This is due do the potential for mechanical failures, such as connectivity issues, power losses or computer crashes, and to system quirks. It is possible for an automated trading system to experience anomalies that could result in errant orders, missing orders, or duplicate orders. If the system is monitored, these events can be identified and resolved quickly. Over-optimization. Though not specific to automated trading systems, traders who employ backtesting techniques can create systems that look great on paper and perform terribly in a live market. Over-optimization refers to excessive curve-fitting that produces a trading plan that is unreliable in live trading. It is possible, for example, to tweak a strategy to achieve exceptional results on the historical data on which it was tested. Traders sometimes incorrectly assume that a trading plan should have close to 100% profitable trades or should never experience a drawdown to be a viable plan. As such, parameters can be adjusted to create a "near perfect" plan – that completely fails as soon as it is applied to a live market. (This over-optimization creates systems that look good on paper only. For more, see Backtesting And Forward Testing: The Importance Of Correlation.) Server-Based Automation Traders do have the option to run their automated trading systems through a server-based trading platform such as Strategy Runner. These platforms frequently offer commercial strategies for sale, a wizard so traders can design their own systems, or the ability to host existing systems on the server-based platform. For a fee, the automated trading system can scan for, execute and monitor trades – with all orders residing on their server, resulting in potentially faster, more reliable order entries. Conclusion Although appealing for a variety of factors, automated trading systems should not be considered a substitute for carefully executed trading. Mechanical failures can happen, and as such, these systems do require monitoring. Server-based platforms may provide a solution for traders wishing to minimize the risks of mechanical failures. (For related reading, see Day Trading Strategies For Beginners.) الموضوع الأصلي: Auto Trading Made Easy + السيارات التجارية | | الكاتب: elnagm | | المصدر: شبكة بني عبس

|

«

الموضوع السابق

|

الموضوع التالي

»

| يتصفح الموضوع حالياً : 1 (0 عضو و 1 ضيف) | |

|

|

مواضيع مشابهة

مواضيع مشابهة

|

||||

| الموضوع | الكاتب | القسم | الردود | آخر مشاركة |

| لكلى محبى السيارات وخاصة مهندسين السيارات تعرف على كل جديد فى عالم السيارات | هنداتوفيق | المنتدى العــــــــــــــــام | 0 | 27-03-2014 06:22 AM |

| افضل بروكر, التحليل الفنى من Trading 212 | EUR\USD | المنتدى الإعلامــــي | 0 | 12-03-2013 12:08 AM |

| معنى made in P.R.C | بن سرور | المنتدى العــــــــــــــــام | 5 | 05-10-2011 01:28 AM |

| رفع أسعار السيارات مقابل الغذاء .. مسؤول سعودي يؤكد : أسعار السيارات سترتفع بنسبة 8% | ابو ريان الرشيدي | المنتدى الإعلامــــي | 14 | 27-03-2009 09:40 AM |

الساعة الآن +4: 12:39 PM.